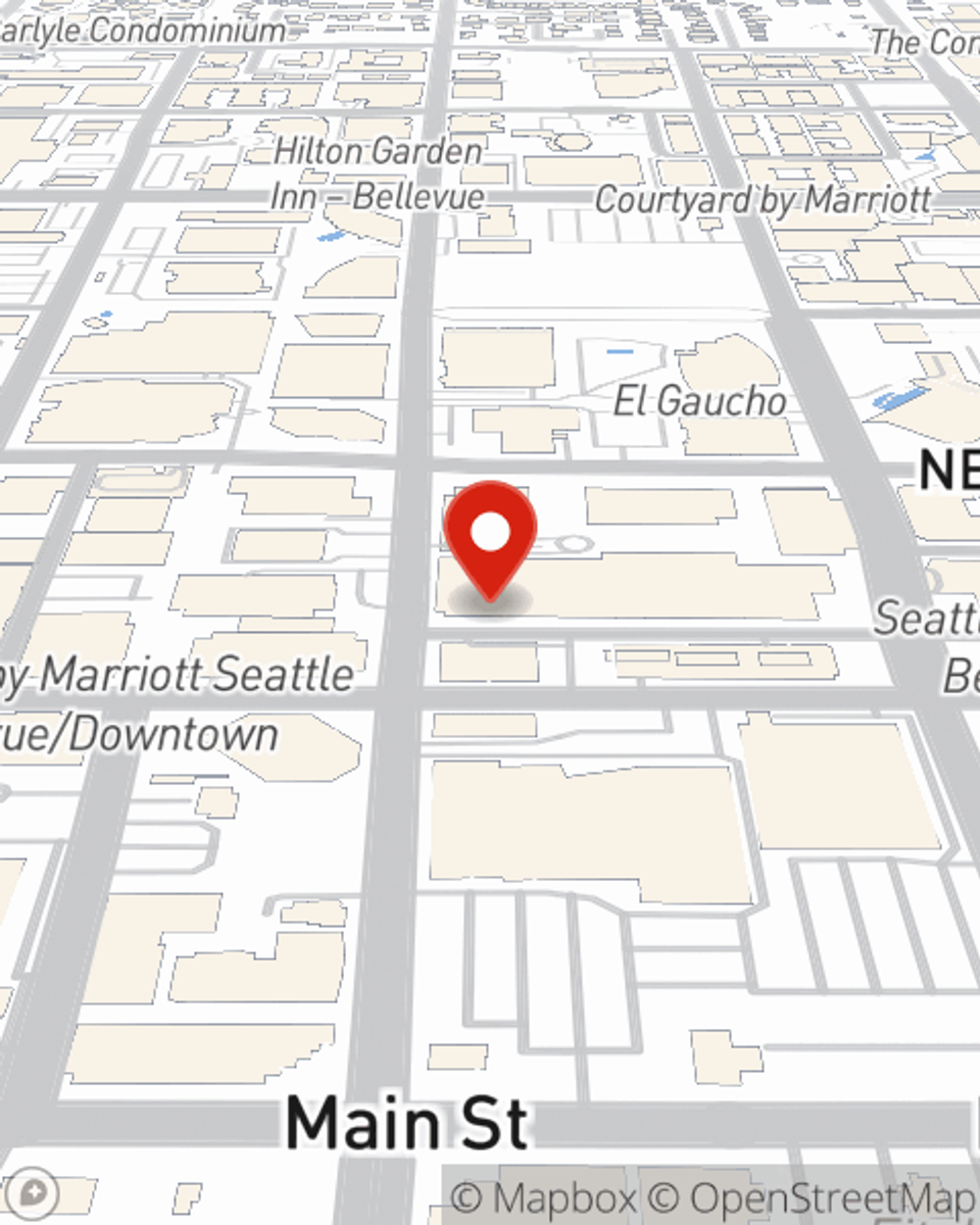

Condo Insurance in and around Bellevue

Bellevue! Look no further for condo insurance

Cover your home, wisely

Your Search For Condo Insurance Ends With State Farm

Your condo is your safe place. When you want to wind down, catch your breath and unwind, that's where you want to be with family and friends.

Bellevue! Look no further for condo insurance

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

We get it. That's why State Farm offers great Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Malinda Zampera is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that's right for you.

Ready to take the next step? Agent Malinda Zampera is also ready to help you see what customizable condo insurance options work well for you. Visit today!

Have More Questions About Condo Unitowners Insurance?

Call Malinda at (425) 453-1800 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Malinda Zampera

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.